Reliable Business Setup

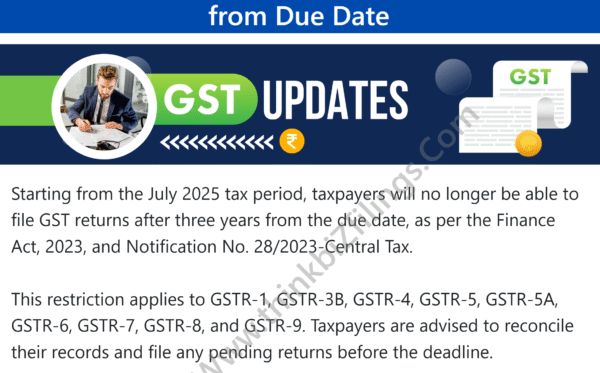

GSTR-3B: Due on the 20th of Every Month

IMPORTANT DATES : > Payment of TDS/TCS of January. In case of government offices where TDS/TCS is paid by book entry, same shall be paid on the same day on which tax is deducted or collected. : 07/02/2025 > Return of External Commercial Borrowings for January. : 07/02/2025 > Payment of Equalization levy (Google Tax) charged on specified services during January. : 07/02/2025 > Monthly Return by Tax Deductors for January. : 10/02/2025 > Monthly Return by e-commerce operators for January. : 10/02/2025 > "Monthly Return of Outward Supplies for January. Manual entry of HSN has been replaced by choosing correct HSN from given Drop down. Also, Table-12 has been bifurcated into two tabs B2B and B2C, to report these supplies separately. Further, warning regarding values of the supplies and tax amounts involved in the same, will also be given for both the tabs of Table-12. " : 11/02/2025 > Optional Upload of B2B invoices, Dr/Cr notes for January under QRMP scheme. : 13/02/2025 > Monthly Return by Non-resident taxable person for January. : 13/02/2025 > Monthly Return of Input Service Distributor for January. : 13/02/2025 > Issue of TDS Certificate u/s 194-IA for TDS deducted on Purchase of Property in December. : 14/02/2025 > Issue of TDS Certificate for tax deducted on rent above 50,000 pm by certain individuals/HUF under Section 194-IB where lease has terminated in December. : 14/02/2025 > Issue of TDS Certificate for tax deducted u/s 194M on certain payments by individual/HUF in December. : 14/02/2025 > Issue of TDS Certificate for tax deducted u/s 194S on Virtual Digital Assets in December. : 14/02/2025 > Issue of TDS certificates other than salary for Q3 of FY 2022-23. : 15/02/2025 > CAG Empanelment of CA firms/LLPs for FY 2024-25. : 15/02/2025 > ESI payment for January. : 15/02/2025 > E-Payment of PF for January. : 15/02/2025 > Details of Deposit of TDS/TCS of January by book entry by an office of the Government. : 15/02/2025 > Monthly Return by persons outside India providing online information and data base access or retrieval services, for January. Also to be filed by every registered person providing online money gaming from a place outside India to a person in India. : 20/02/2025 > Add/amend particulars (other than GSTIN) in GSTR-1 of Jan. It can be filed after filing of GSTR-1 but before filing corresponding GSTR-3B. : 20/02/2025 > Summary Return cum Payment of Tax for January by Monthly filers. (other than QRMP). : 20/02/2025 > Deposit of GST of January under QRMP scheme. : 25/02/2025 > Return by persons with Unique Identification Number (UIN) like embassies etc to get refund under GST for goods and services purchased by them, for January . : 28/02/2025 > Complete CPE Hours for Calender year 2024. Update Unstructured CPE hours details like reading of ICAI journal at https://cpeapp.icai.org. : 28/02/2025

Virtual CFO

Strategic financial leadership for smarter, scalable growth and informed decision-making.

GST and Income Tax

Partnering with you to ensure 100% compliance, effortlessly, accurately, on time.

Since

2018

1

+

Successfully finished projects with creativity.

1

+

Trusted clients who love our consultancy.

1

+

Ongoing projects are being worked on by our team.

About Us

A Premier Arena for Business Solutions

Specializing in providing comprehensive consultancy services to small, medium, and large businesses, ensuring full compliance with Indian laws and regulations.

we offer tailored solutions to individuals, entrepreneurs, corporate entities, and others, helping them navigate and resolve challenges encountered in their daily operations.

Expert Team

The framework and method depends on expert team.

Target Fulfil

The framework and method depends on expert team.

Services

The fields on which we give services

MCA Compliances

MCA Compliances ensure your business meets legal requirements, maintaining governance and timely filings...

Goods and Service Tax

GST services for seamless registration, filing, and compliance with tax regulations...

Accounting & Payroll

Accounting & Payroll services to ensure timely, accurate financial management and smooth employee compensation...

Incorporations

Starting your business is exciting, and we simplify the process. We help you register and ensure legal compliance...

Income Tax

Managing tax and compliance can be overwhelming, but we simplify it with expert return filing for individuals and businesses.

Registrations

Starting a business requires multiple licenses and registrations. We handle it all, so you can focus on your goals...

Register a Company Today!

Get 20% discount to get By Company Incorporation with moneyback guarantee.

Fetaured services

We Offer the Best Services For You!

Popular Services

Startup Registrations

Seamless Startup Registrations for a Strong Start.

- Private Limited Company

- Limited Liability Partnership

- One-Person Company

Recommended

Accounting & Payroll

Effortless 100% Virtual Accounting and Payroll Services.

- Bookkeeping & Accounting

- Income Tax Return Filings

- GST Return Filings

MCA Compliances

Ensuring MCA Compliances for Legal Business Operations.

- Company ROC Filings

- Change Services

- Closure Services

The most trusted

Accounting & Tax

platform

01

Recognized by Govt. of India

02

Professional Assisted

03

Data Security Trust

04

e-XPRESS

Services

05

ISO Certified

06

Quick Response Team

07

Assured Satisfaction

08

Transparent

Pricing

01

Recognized by Govt. of India

02

Professional Assisted

03

Data Security Trust

04

e-XPRESS

Services

05

ISO Certified

06

Quick Response Team

07

Assured Satisfaction

08

Transparent

Pricing

Collaboration

Empowering businesses through seamless collaboration and expert services.

Driving innovation with cutting-edge digital solutions.

Innovative software boosting business productivity and growth.

Reliable accounting software simplifying finances for all businesses.

Trusted digital signature and PKI solutions, secure authentication, and efficient document signing.

Comprehensive financial solutions driving growth and security for individuals and businesses.

Streamlining secure and seamless payment processing.

Testimonial

We appreciate our clients!

“ The team was very responsive to my queries and guided me through the entire process. Highly recommended!.”

Praveen Binjageri

Director of Prathiksh Network Pvt.Ltd

"the team was very patient and guided me through each and every step. They helped me with the required documents and ensured my application was error-free. Great service!."

Kannaya Koushik

CEO of Blue Illusion

"My experience with thinkbiz is nice and perfect. In future also if I need any official work to do I will certainly choose thinkbiz filings.."

Asad Khan

Proprietor of Golden Soilers

"Prompt response and committed to complete job on time."

Chelmatikary Sathaiah

Sigan Semiconductors

"ITR Filing queries have been addressed and processed the request promptly."

Charan Yallanki

"Good and fast service."

GOVINDA NAIK N

Director of Govini Avi Designs

"The CA firm stands out for its thorough attention to detail and personalized financial guidance. Their team is knowledgeable, approachable, and committed to client success. A reliable partner for all your accounting and compliance needs."

Dhanunjaya DM

Director of Svajeya Services Pvt.Ltd

"Excellent services, team is very cooperative. Must recommended.."

Bhaskar Anke

Proprietor of Bhaskar Constructions

"I strongly recommend ThinkBiz Filings to every business and especially for young startups."

Kallevar swaraj

"Mr.Karthik helped me to get GST no. to my business, the process was hassle free. I thank and recommend Thinkbiz Filings for their prompt services."

Rama Chary

Partner of Star Force Creations

"Don't have a second thought for assistance related to registering your company. Their team is really helpful right from the incorporation of your company, filing your trademark, registering your GST etc. Also they will take care of your company's compliance. Their patience and helpful suggestions are commendable. A one stop destination to all your documentation and registrar works."

SHRIKKAR Tr

Director of Blueprint Sutra

"great support, I absolutely would like to continue working with thinkbiz filings to manage our accounts and compliance."

Katkuri Venu

"Explained the stages of verification of trademark logo very patiently and cleared all my queries."

Yeloori Chaitanya96

"Very good and fast service, we have tried before with other companies but thinkbiz Filings provided the best service."

Vinod

"Their invaluable support in launching my business and also solving complex issues easier to handle makes my operations a breeze."

ysushi

"My experience was good with the company. They were quick to assist with all my work and delivered all related service superfast. I recommend ThinkBiz Filings to every individual and business, who is looking to incorporate and tax related compliances their business."

Satheesh Yadav

"Great service. Karthik help me to file my Filings. Listen all queries and suggest the good benifits."

Chiranjeevi Gunja

"I was impressed by the work of thinkbiz filings India private limited they provide quick solution to all my legal needs and I highly recommend there services for anyone seeking assistance."

Kiran Desineni

"I have an excellent experience with think biz fillings inda private limited. the service were expertly delivered team was highly knowledgeable and efficient ."

Gokam Vishnu

"Thinkbiz filings India private limited offers excellent services, they ensure a smooth and hassle-free process, making them a top choice for businesses in India."

Vinay Kumar

"I was impressed with their professionalisam and attention to detail. thanks to thinkbiz filing india private limited."

Gobburi Sai kumar

"ThinkBiz Filings is seriously fantastic! They make filing business paperwork a breeze. It's such a relief to have a company like them to rely on. They're definitely worth a shoutout! 🎉👍🏼."

Vinay Kannapuram228

"Great service. People were kind and gentle. They communicate well and save the it returns on our side. I recommend you to consult and clarify your IT return, Audit, income tax problems."

Mahebub Ali

"As a first-time entrepreneur, I was unsure of the intricacies of company incorporation. I am very grateful for his assistance and highly recommend Thinkbiz filings to anyone seeking a reliable and professional company incorporation service."

Surabhi Naresh

"They are very professional in helping out the LLP registration without Hassle free."

Kurleay Anusha

"I have been working with Karthik since my company registration, he is really helpful and was there throughout the process."

srisailaxmi Mudiraj

"Thanks for all to make my business. good service. quick solutions for all."

Shivani Guni

"They did my company's IT filling

n other processes very well and really satisfied I hope they will keep their standards in future too."

Gajji Sirisha

"Quick and fast response and completed task without any delay simply superb

Service."

Aakash Sagar

"I am getting my company compliance done from Thinkbiz Filings from 2 years. They are doing the excellent job."

Vamshi Jupally

"Provided very fast service very cooperative, punctual, faithful."

Sri Lekha

"I had an amazing experience with this company! Open communication with quick service and very trustworthy."

NIHARIKA SANKATA

"Absolutely proactive and humble service. Thank you for making my experience smooth. All the best."

Poojitha Uppuganti

"Excellent working experience and friendly behavior. I highly appreciate."

Varsha Jupally

"Highly recommended. We have our company registered recently. It was smooth. Working with Karthik was good."

Vittamraj Pallavi

"Such a wonderful responsible and accountable about the client. Quick response I am completely impressed, and I highly recommend thinkBiz filing for all end-to-end start up PVT LTD process, IE: Co reg, Esig, MOA, GST. bundle of thanks from MAKDEL SERVICES PVT LTD."

Makdel HSE Services

"Timely service, good communication skill, keep up ur good work."

BASKER VUDUTHALA

"Service given by the team is good, Karthik was most friendly during the work."

govindu sandeep

"Its really great.. I am really impressed with the ThinkBiz filings team. Thank you for the great service."

IND ORIGNALS

"Thank you for helping me with the gst registration. I appreciate the patience you had during all this time. It's good that you always reply to the questions I had, and you were available. I understand this process is time taking but you've been

prompt and helpful. All the best."

Narsimha Reddy

"Great service from thinkbiz, I was associate with the Karthik and his response was always good at any time and explain everything clearly."

skh engineering and construction

"Excellent Service for filing of my income tax returns, On-time and very nicely coordinated and communicated. Thank you thinkbiz filing."

Md Zubaid Khan

"Very Quick responses and super helpful .they helped me refile my income tax returns with all required clarifications .Highly recommended Thinkbiz filings."

Baskar Rao

"I am happy with the dedication and commitment ,has shown to startup India registration of my company. I heart fully appreciate Mr.karthiks work and patience. Good work Team of ThinkBiz Filings ... Keep it going .."

Sandesh

"Very Prompt Response and Good Service."

Sreekanth Motamarry

"Really super fast service. I worked with Karthik he is really super supportive and informativeThank for the help."

Hemanth Pakala

"Quick turnaround and hassle-free filing. Appreciate thinkbiz filings reliability, professionalism and high quality of service. Keep up the Good work."

Vinay Dad

"Great support from team ThinkBiz Filings .Whole process was very smooth and transparent. Package suggested to us was value for money. Compliance manager guided us throughout the process of LLP incorporation.

Thanks for your kind support."

naidu Dj

"My experience was good with the company. They were quick to assist with all my work and delivered all related service superfast. I recommend ThinkBiz Filings to every individual and business, who is looking to incorporate and tax related compliances their business."

tadakala kiran kumar

Latest blogs

We have achieved some great Funfacts for experiences

Clients