Get

MSME Registration

Claim your access to Government Subsidies, Priority Lending and a quick start up. Register for MSME/Udyog Aadhar at INR 1499/- only.

Get Quote Instantly in a Minute!

What is SSI MSME Registration?

All you need to know

To avail the benefits under the MSME Act from Central or State Government and the Banking Sector, MSME Registration is required. MSME stands for micro, small and medium enterprises and any enterprise that falls under any of these three categories. Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades.

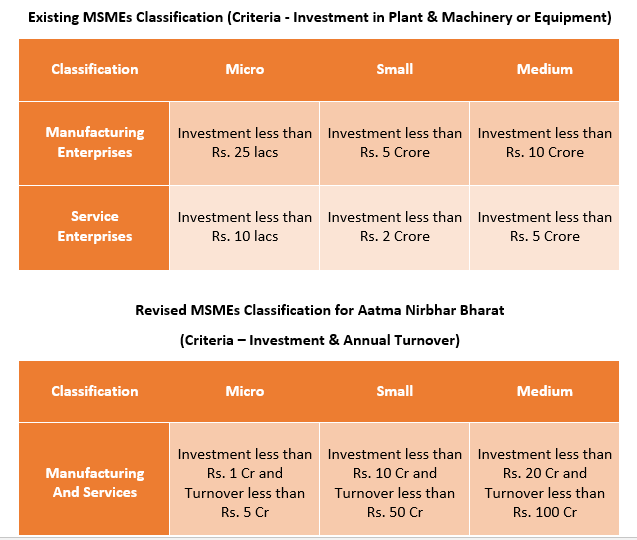

On 13th may, 2020 Government of India announced some major relief to the MSMEs. And one of the major relief is that the Government Revised the definition of the MSMe as a whole.

Under the new definitions, the distinction between manufacturing and services enterprises has been eliminated and the investments have been revised upwards and an additional criteria of turnover has been introduced.

What is the new & Revised definition of MSMe?

The new definition of MSMe is as follows:

Micro Enterprise: Manufacturing and services enterprises with investments up to Rs 1 crore and turnover up to Rs 5 crore will be classified as micro enterprises.

Small Enterprise: For small enterprises, the investment criteria and the turnover criteria has been revised upwards to Rs 10 crore and Rs 50 crore respectively.

Medium Enterprise: The enterprises which have investment up to Rs 20 crore and turnover up to Rs 100 crore will be termed as medium enterprises.

Table showing existing and revised definition of MSMe:

The new definition will benefit all the MSMes as they need not worry about growing in size; they will still be able to get quite a lot of benefits which otherwise, as an MSME, they have got.

The new definition will benefit all the MSMes as they need not worry about growing in size; they will still be able to get quite a lot of benefits which otherwise, as an MSME, they have got.

This said new definition of MSMe is a welcome move for the promotion of the Atma Nirbhar Bharat Abhiyan by the Government of India.

Any Micro, Small and medium-sized enterprises in the manufacturing and service sector can obtain MSME Registration. MSME is used interchangeably with SSI, which stands for Small Scale Industries.

Though the MSME registration is not statutory, it is beneficial for business at it provides a range of benefits such as eligibility for capital investment subsidies, lower rates of interest, tax subsidies, power tariff subsidies, and other support. You may also avail our e-Xpress service to obtain SSI registration / MSME registration within one working day.

Thinkbiz filings! is an eminent business platform and a progressive concept, which helps end-to-end incorporation, compliance, advisory, and management consultancy services to clients in India and abroad. Registering for SSI/MSME is easy, seamless, cheapest and quickest with Thinkbiz filings!

You may get in touch with our compliance manager on 09704561215or email info@Thinkbizfilings.com for for free consultation.

MSME Registration Fees

Choose Your Package

ULTIMATE

- eXpress SSI/MSME Registration (within 24 hours)

- eXpress Trademark (1 application 1 class) (start ups, proprietorship & small business)

Compliance Requirements for a Partnership Firm

Income Tax Return

GST Compliances

TDS Compliance

Accounting

Tax Audit (if applicable)

Firm Updates

Documents Required for Partnership Firms

Quick Checklist

- PAN card of all partners of the firm.

- Aadhaar/Passport/Voter ID/Driving License of all partners.

- Latest utility bill, rent agreement, or ownership proof of the firm’s office.

- Latest bank statements of partners.

- Recent photos of all partners.

Key Benefits of a Partnership Firm

Points to make your decision easy

Ease of Formation

Tax Benefits

Lower Compliance

Decision-Making

Profit Sharing

No Minimum Capital

Our most honorable clients

FAQs On SSI/MSME/Udyog Aadhar Registration

- A Private Limited Company must have a minimum of two Directors and can have up to a maximum of fifteen Directors. But if you are a sole owner, you can incorporate an OPC as well.

- Pvt. Ltd. Co. and LLP have a lot of similarities yet they both are different in many of its characteristics and structures. When you wish to start your business, there are many factors that one needs to think upon before selecting any business structures. However, before selecting any business structure, you may refer LLP vs Pvt Ltd- A comparison between two important forms of organisation in India

- It generally takes 8-10 working days to register Private Limited Company in India. The time taken for registration totally depends on the submission of relevant documents by the client and the speed of Government Approvals. To ensure quick and speedy registration, choose a unique name for your Company. The registration fees for the incorporation is inclusive in the package offered to you.

- It generally takes 8-10 working days to register Private Limited Company in India. The time taken for registration totally depends on the submission of relevant documents by the client and the speed of Government Approvals. To ensure quick and speedy registration, choose a unique name for your Company. The registration fees for the incorporation is inclusive in the package offered to you.

- There exists no bar on turnover or capital in private Limited Company unlike One person Company.

- Incorporating a company through Simplified Proforma for Incorporating Company electronically (SPICe plus), with eMoA (INC-33), eAOA (INC-34), is the default option and most companies are required to be incorporated through SPICe only.

- Minimum two directors are required to incorporate a private limited company. Companies Act, 2013, has introduced the concept of One Person Company (OPC) private limited, in which a single individual can start a private limited company. Thus, if you plan to incorporate OPC, you can incorporate it with only one director.

- The Ministry of Corporate Affairs (MCA) mandates that the Directors sign some application documents using their Digital Signature. Hence, a Digital Signature is required for all Directors of the proposed Company. Digital Signature application is to be filed to get a DSC.

- Yes, a Foreign National or an NRI can become a Director of a Private Limited Company in India after obtaining Director Identification Number (DIN). However, it may be noted that at least one Director on the Board of Directors must be a Resident India.

- Thinkbizfilings provides Proprietorship Registration all across India. You can obtain Proprietorship registration in Hyderabad, Vijayawada,Pune, Bangalore, Chennai, Delhi, Kolkata, or any other cities easily with us.

- Don’t worry!! Our expert will help you to choose the best suitable plan for you. Get in touch with our team to get all your queries resolved. Write to us at info@thinkbizfiling.com or call us @+91 970 456 1215