GST Compliance Checklist for FY 2025-26

As businesses step into FY 2025-26, ensuring GST compliance is crucial for smooth operations and avoiding penalties. Here’s a comprehensive checklist to help businesses stay compliant with GST regulations:

1. Annual GST Registration & Updates

✔ Verify GST registration details and update if required.

✔ Ensure correct business details, authorized signatory, and contact information.

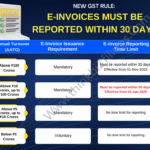

2. E-Invoicing Compliance

✔ Businesses with turnover above ₹100 crore must report e-invoices within 30 days on the Invoice Registration Portal (IRP) (effective 1st May 2025).

✔ Validate the Invoice Reference Number (IRN) for all B2B transactions.

3. GST Returns & Filing Deadlines

✔ File GSTR-1 (Outward Supplies) and GSTR-3B (Monthly Summary Return) on time.

✔ Match GSTR-2B (Auto-populated ITC statement) with purchase records.

✔ File GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) before the due date.

4. Input Tax Credit (ITC) Reconciliation

✔ Reconcile ITC claims with GSTR-2B & purchase invoices to avoid mismatches.

✔ Ensure timely payments to suppliers (within 180 days) to avail ITC.

5. GST Payment & Ledger Balances

✔ Maintain sufficient balance in Electronic Cash Ledger for tax payments.

✔ Verify Electronic Credit Ledger for accurate ITC utilization.

6. Reverse Charge Mechanism (RCM) Compliance

✔ Identify transactions liable for RCM and pay tax accordingly.

✔ Maintain proper records and claim ITC on RCM payments where applicable.

7. E-Way Bill & E-Invoice Reconciliation

✔ Ensure proper generation of E-Way Bills for goods movement.

✔ Cross-check invoices with e-way bill records to avoid mismatches.

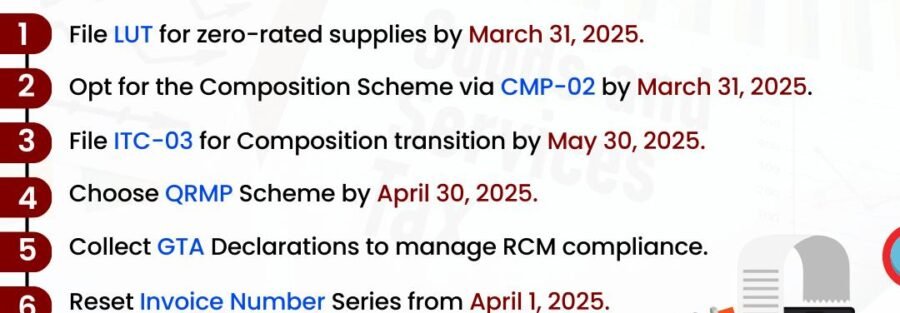

8. New GST Amendments & Notifications

✔ ISD Mechanism Mandatory (from 1st April 2025) – Common input services must be distributed via Input Service Distributor (ISD).

✔ New TDS Provisions (Rule 194T) – TDS on payments to firm partners under the Income-tax (Seventh Amendment) Rules, 2025.

9. GST Notices & Compliance Audits

✔ Respond to any pending GST notices or scrutiny assessments.

✔ Prepare for possible GST audits by maintaining accurate records.

10. Digital Record-Keeping & Automation

✔ Automate GST filing processes to reduce errors.

✔ Maintain digital records for easy retrieval during audits or investigations.

Conclusion

Staying GST-compliant in FY 2025-26 requires businesses to be proactive in filing returns, reconciling ITC, and keeping up with the latest GST amendments. Using automated solutions and regular monitoring will help businesses avoid penalties and ensure smooth GST operations.