Choosing Between GST Composition and Regular Scheme: A Comprehensive Guide

Introduction

Goods and Services Tax (GST) is a pivotal tax reform in India, streamlining indirect taxation for businesses across sectors. One of the fundamental decisions every registered taxpayer must make is choosing between the Composition Scheme and the Regular Scheme. This decision significantly impacts tax liability, compliance obligations, and overall business efficiency.

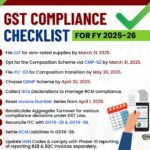

The Composition Scheme simplifies GST compliance for small businesses by offering lower tax rates and reduced filing requirements. Conversely, the Regular Scheme provides businesses with the advantage of claiming Input Tax Credit (ITC) and conducting inter-state transactions, albeit with higher compliance obligations. Importantly, under Rule 3(3) of the CGST Rules, 2017, businesses wishing to opt for the Composition Scheme must file Form GST CMP-02 before the end of the financial year, specifically before 31st March 2025, to ensure smooth compliance and transition.

Businesses must carefully evaluate profit margins, transaction values, transaction types (B2B/B2C), and GST rates while deciding on the GST scheme. The following matrix clearly indicates the preferred scheme:

| Scenario | Margin | Transaction Value | Transaction Type | Recommended Scheme |

|---|---|---|---|---|

| Low Margin, Low GST Rate | Low | Low/High | Any | Regular Scheme |

| High Margin, High GST Rate | High | Low/Moderate | B2C | Composition Scheme |

| B2B Transactions | Any | Any | B2B | Regular Scheme |

| B2C Transactions | High | Low/Moderate | B2C | Composition Scheme |

| High Value, Low Margin | Low | High | Any | Regular Scheme |

For instance, consider fertilizers with a margin of ₹5 and a GST rate of 5% on an MRP of ₹300. Under the Regular Scheme, GST payable is ₹0.25 (5% of ₹5 margin). However, under the Composition Scheme, GST payable would be ₹3 (1% of ₹300), making the Regular Scheme more beneficial.

Another example is gold worth ₹80,000 with a margin of ₹1,000 and a GST rate of 3%. GST payable under the Regular Scheme would be ₹30 (3% of ₹1,000 margin). Under the Composition Scheme, GST payable would be ₹800 (1% of ₹80,000), significantly increasing the tax burden, making the Regular Scheme preferable.

15 Key Considerations for Choosing a GST Scheme

Aggregate Turnover – Eligibility Criteria

Composition Scheme: Suitable for businesses with an annual aggregate turnover of up to ₹1.5 crores (₹75 lakhs for special category states).Regular Scheme: Mandatory for businesses exceeding the prescribed turnover limit but also available for businesses opting for ITC benefits.Nature of Transactions

Regular Scheme: Permits both intra-state and inter-state transactions.Composition Scheme: Restricted to intra-state transactions only.GST Rates – Taxation Structure

Regular Scheme: Standard GST rates of 5%, 12%, 18%, and 28%.Composition Scheme: Fixed concessional tax rates:

1% for traders/manufacturer

- 5% for restaurant services

- 6% for service providers

Input Tax Credit (ITC)

Regular Scheme: Allows ITC.Composition Scheme: No ITC available.Compliance Requirements – Filing of Returns

Regular Scheme: Monthly filings – GSTR-1, GSTR-3B, Annual GSTR-9.Composition Scheme: Simpler filings – Quarterly CMP-08, Annual GSTR-4.Type of Goods – Exclusions

Certain goods (ice cream, pan masala, tobacco, aerated water) are excluded from the Composition Scheme.Reverse Charge Mechanism (RCM)

Regular Scheme: Allows ITC on RCM transactions.Composition Scheme: No ITC on RCM transactions.Stock Management & Scheme Transition

Transitioning between schemes impacts ITC on closing stock.Compliance Simplicity

Composition Scheme reduces compliance complexity.Late Fees and PenaltiesRegular Scheme has higher penalties.

Profitability – GST ImplicationsRegular Scheme aligns GST with actual profit margins.

Seamless Credit Availability to Purchasers1 1. Regular Scheme allows ITC availability, vital for B2B businesses.

High-Value Transactions – GST Impact1. Regular Scheme is beneficial for high-value transactions with low margins.

Conclusion

Choosing between GST schemes requires careful assessment of turnover, transaction types, profitability, GST rates, and compliance capacities. Consulting a Chartered Accountant ensures the best strategic choice for business growth and regulatory compliance.

Disclaimer: The views expressed in this article are personal to the authors and are an attempt to interpret the GST law. Professional assistance is recommended where required.