E-Invoices Must Be Reported Within 30 Days: New GST Compliance Rule

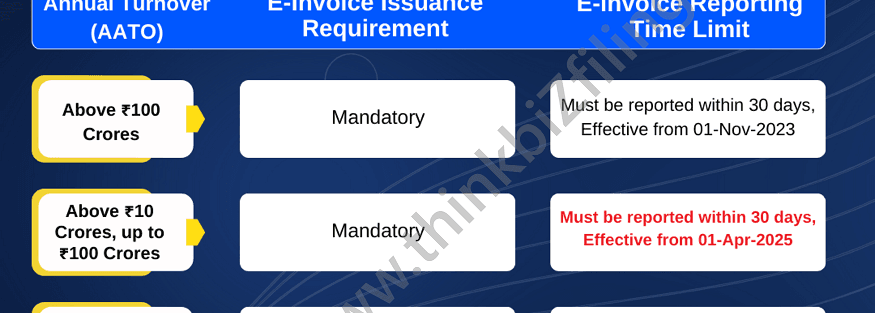

In a significant update for businesses, the government has mandated that all e-invoices must be reported on the Invoice Registration Portal (IRP) within 30 days from the date of invoice generation. This rule applies to taxpayers with an aggregate turnover exceeding ₹100 crore, effective from 1st May 2025.

Understanding E-Invoice Reporting

E-invoicing under GST is a system where invoices are electronically authenticated by the government before being used for transactions. Once reported, the IRP assigns a unique Invoice Reference Number (IRN), ensuring the invoice’s validity and compliance.

Key Highlights of the New Rule

Mandatory Timely Reporting – Invoices not reported within 30 days will be considered non-compliant.

Applicability – This applies to businesses with a turnover above ₹100 crore.

Non-Compliance Risks – Late reporting may lead to penalties and ineligibility to claim Input Tax Credit (ITC).

No Retroactive Reporting – If not reported within the deadline, businesses cannot retrospectively generate an e-invoice.

Impact on Businesses

Streamlined ITC Claims: Timely e-invoice reporting ensures faster ITC reconciliation for businesses.

Avoidance of Penalties: Failure to comply may lead to fines under Section 122 of the CGST Act.

Operational Adjustments: Businesses must upgrade their ERP systems to ensure real-time compliance with this rule.

Steps to Ensure Compliance

Automate E-Invoice Generation – Use integrated ERP software to auto-report invoices to the IRP.

Regular Monitoring – Designate teams to track invoices nearing the 30-day deadline.

Training & Awareness – Educate finance teams about the new reporting rules and implications.

Conclusion

The 30-day reporting mandate for e-invoices aims to enhance transparency and prevent tax evasion. Businesses must promptly align their systems and workflows to ensure compliance, avoiding penalties and ensuring seamless GST operations.