Mandatory ISD Registration from 1st April 2025 – Key Updates & Compliance Guide

The Finance Act, 2024, has introduced a major reform in GST compliance by making Input Service Distributor (ISD) registration mandatory from 1st April 2025 for businesses distributing Input Tax Credit (ITC) from common input services procured from third parties.

Understanding ISD & Cross Charge

What is ISD?

An Input Service Distributor (ISD) is an office of a business that receives invoices for input services and distributes the ITC to its branches or units having the same Permanent Account Number (PAN). The ISD issues invoices to allocate ITC correctly across different business locations.

What is Cross Charge?

Cross Charge applies when one branch/unit of an organization provides services (e.g., HR, IT, accounting) to another. Under GST, branches in different states are treated as distinct persons, making cross-chargeable services taxable, even if there is no consideration.

Scenario Up to 31st March 2025

Until 31st March 2025, businesses could choose between Cross Charge and ISD for distributing ITC. Circular No. 199/11/2023-GST clarified that ISD registration was not mandatory in all cases.

Why Businesses Preferred Cross Charge Over ISD?

No Separate GST Registration: ISD requires an additional GSTIN along with normal registration.

Simplified Process: Under Cross Charge, businesses issue invoices instead of filing separate ISD returns.

Flexibility in Distribution: Cross Charge allows ITC distribution based on open market value, whereas ISD follows a turnover-based distribution.

Key Update from the 50th GST Council Meeting

The 50th GST Council Meeting recommended clarifying that:

✅ ISD was not mandatory earlier for common input services.

✅ However, a legal amendment would make ISD mandatory for distributing third-party input services.

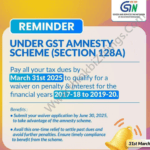

Mandatory ISD Registration w.e.f. 1st April 2025

The Finance Act, 2024, amended the GST law to compulsorily route ITC through ISD for third-party services. Cross Charge can no longer be used for these transactions.

Key Compliance Requirements from April 2025

✔ Separate GSTIN Required for ISD registration.

✔ Invoices for Input Services must be issued in ISD’s GSTIN.

✔ GSTR-6 Filing is mandatory for ISD to transfer input tax credit.

✔ ITC Distribution as per GST Rules (Section 39).

ISD Compliance Checklist

✅ Registration: Businesses must apply using GST REG-01 (selecting ISD).

✅ Invoicing: ISD invoices must include:

- GSTIN of ISD & recipient

- Unique serial number

- Taxable value, GST rate & ITC amount

✅ Monthly Filing:

- GSTR-6 (due by the 13th of the next month)

- Auto-population in GSTR-6A for recipient branches

- ITC Claiming: Branches must

- claim distributed ITC in their GSTR-3B returns.

Impact on Businesses

Ensures Structured ITC Allocation: ISD enables centralized ITC distribution.

Reduces Tax Complexity: Provides clarity on third-party service taxation.

Compliance Burden Increases: Businesses need to adapt systems for ISD invoicing & reporting.

Conclusion

The mandatory ISD mechanism from April 2025 aims to streamline ITC distribution and improve compliance for businesses operating with multiple GST registrations. Companies should start preparing now to ensure a smooth transition before the new rules take effect.